|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding VA Mortgages in Florida: A Comprehensive GuideIntroduction to VA MortgagesVA mortgages are a unique offering available to veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans are backed by the Department of Veterans Affairs, allowing for more favorable terms, including no down payment and competitive interest rates. In Florida, a state with a significant veteran population, VA loans offer a valuable pathway to homeownership. Eligibility RequirementsWho Qualifies for a VA Loan?To qualify for a VA loan, you must meet specific service requirements, which typically include a minimum period of active duty service. Surviving spouses of deceased veterans may also be eligible under certain conditions. Credit and Income StandardsWhile the VA itself does not impose a minimum credit score, lenders typically have their own requirements. Income stability is crucial, and lenders will assess your ability to repay the loan. Benefits of VA Mortgages

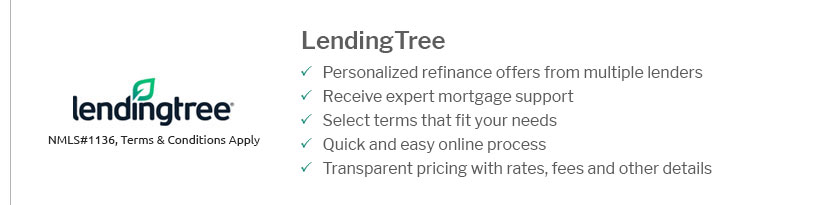

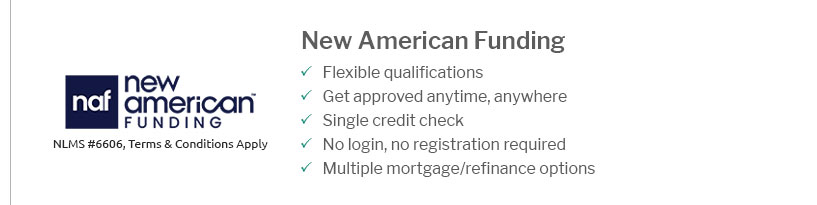

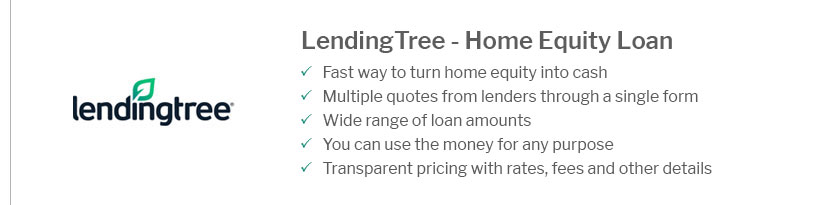

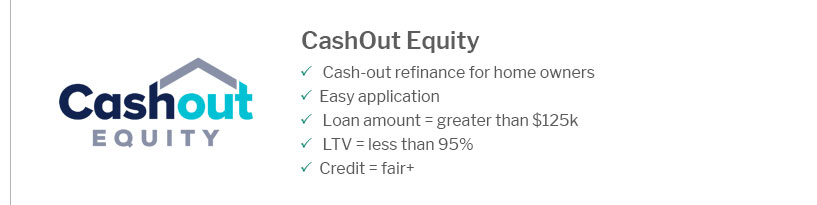

Navigating the VA Loan Process in FloridaFinding a LenderIt's crucial to work with a lender who is experienced with VA loans. They will guide you through the process, ensuring you maximize your benefits. Obtaining a Certificate of Eligibility (COE)The COE is an essential document proving your eligibility for a VA loan. It can be obtained through the VA’s eBenefits portal or by having your lender request it on your behalf. Comparing VA Loans to Other OptionsWhen considering home financing, it's helpful to compare VA loans with other options such as conventional mortgages or home equity loan vs. Each has its benefits, and understanding these can help you make an informed decision. FAQs

https://www.valoansflorida.com/

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval ... https://griffinfunding.com/florida-mortgage-lender/florida-va-loans/

We can help you determine which type of VA mortgage is best suited for you, so you can save when purchasing or refinancing your home. https://www.newamericanfunding.com/loan-types/va-loan/state/florida/

If you have your full VA entitlement (more on that below), there are no loan limits. This means you can borrow as much as you are approved for by your lender ...

|

|---|